Saturday, October 22, 2016

Wednesday, October 19, 2016

Books 71, 72, and 73: I've fallen behind PS PLUS BOOK 74 and a Very Special Guest Star.

I meant to post about Book 71:

But then I didn't right away and then I finished book 72:

And I thought oh man I can't post about that one before I write up book 71 and before I knew it I'd finished book 73:

At which point I figured I'd better just clear the path and get on with my life. So:

Book 71, very good, read it before, still just as good and creepy the second time around, a good horror story so you know this time of year, go for it. My thoughts on it when I read it the first time are in this post here.

Book 72: Awesome. "The Story Of Your Life" is a great time-travel story, and there is a story about religion that blew me away and I'd talk about it more but the point is to get this done and move on, so I would DEFINITELY say read this collection because all the stories are at least good and two are great and one is phenomenal.

Book 73: Surprisingly entertaining and far better than the reviewers would have you believe. A solid book that's not a bad read.

TRUE STORY: I drafted the above and was going to post it but got tied up with stuff, and before I could post it I finished Book 74:

The thing that tied me up between the first three books and the fourth was drawing with Mr Bunches. Specifically, drawing actors who voice-overed the "Angry Birds" movie. This is Tim Allen:

But then I didn't right away and then I finished book 72:

And I thought oh man I can't post about that one before I write up book 71 and before I knew it I'd finished book 73:

At which point I figured I'd better just clear the path and get on with my life. So:

Book 71, very good, read it before, still just as good and creepy the second time around, a good horror story so you know this time of year, go for it. My thoughts on it when I read it the first time are in this post here.

Book 72: Awesome. "The Story Of Your Life" is a great time-travel story, and there is a story about religion that blew me away and I'd talk about it more but the point is to get this done and move on, so I would DEFINITELY say read this collection because all the stories are at least good and two are great and one is phenomenal.

Book 73: Surprisingly entertaining and far better than the reviewers would have you believe. A solid book that's not a bad read.

TRUE STORY: I drafted the above and was going to post it but got tied up with stuff, and before I could post it I finished Book 74:

The thing that tied me up between the first three books and the fourth was drawing with Mr Bunches. Specifically, drawing actors who voice-overed the "Angry Birds" movie. This is Tim Allen:

Tuesday, October 18, 2016

Investment bankers fear a Republican electoral win almost as much as they feared terrorists after 9/11

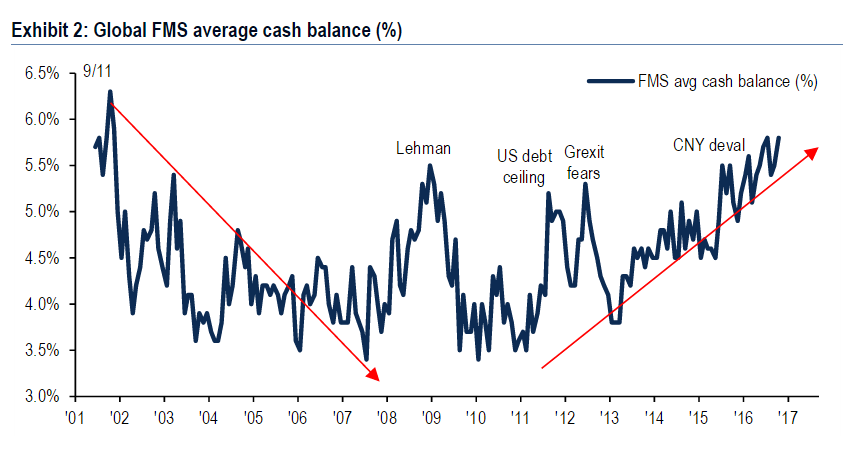

Hamilton Nolan's article on Deadspin this week pointed out that investment managers are keeping cash rather than investing; the levels of cash on hand are nearly 6%, which is apparently very high. The amount of cash they are keeping is according to Bloomberg.com, about the same as when Great Britain voted to leave the EU, and the last time it was higher was just post 9/11. Here's the chart of cash levels:

Note that the cash reserves are now about as high as when Lehman Brothers collapsed, in September 2008, leading to the Great Recession. (Interesting to see also that cash reserves fell, and thus investment was at its highest, in 2010 and 2011). The cash reserves also rose when the Republicans forced a debt ceiling showdown in 2012, and when British conservatives got people to vote to leave the EU.

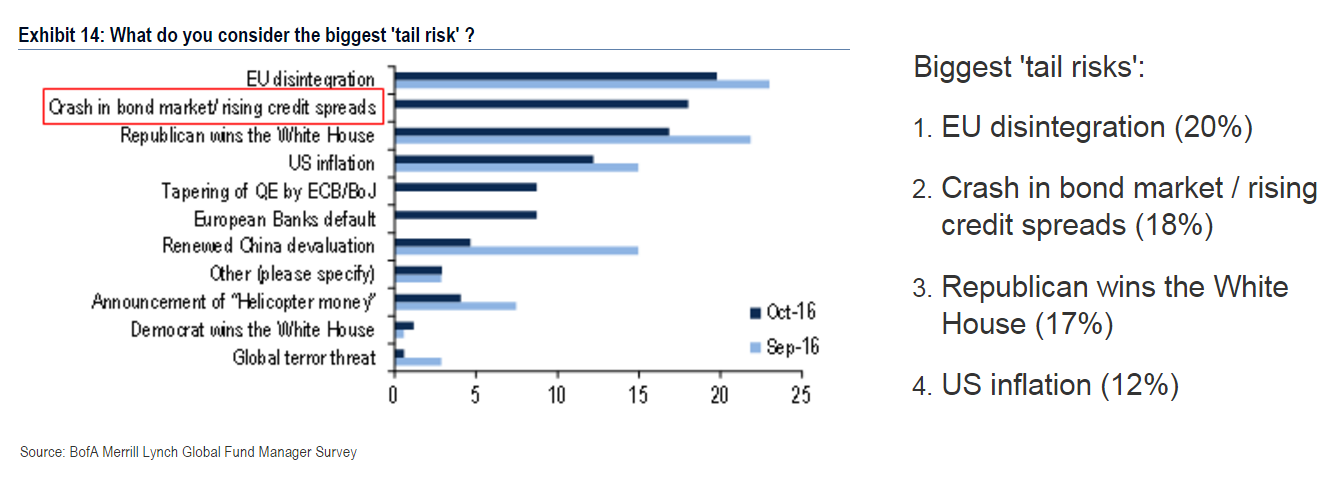

The survey Bloomberg cites notes the three biggest fears investment bankers have:

Bloomberg highlighted that item, not me. I think the real highlight is that investors fear the current Republican party more than they fear Hillary! Which isn't good for either side. If the GOP wins, the economy tanks. If Hillary! wins, the middle class is screwed.

Note that the cash reserves are now about as high as when Lehman Brothers collapsed, in September 2008, leading to the Great Recession. (Interesting to see also that cash reserves fell, and thus investment was at its highest, in 2010 and 2011). The cash reserves also rose when the Republicans forced a debt ceiling showdown in 2012, and when British conservatives got people to vote to leave the EU.

The survey Bloomberg cites notes the three biggest fears investment bankers have:

Bloomberg highlighted that item, not me. I think the real highlight is that investors fear the current Republican party more than they fear Hillary! Which isn't good for either side. If the GOP wins, the economy tanks. If Hillary! wins, the middle class is screwed.

American Construction

This was hanging from a construction site in Madison, one night while Mr F couldn't sleep so I was taking him for a ride.

In 2004, there were 2,070,000 building permits issued for construction in the United States. That number fell each year by about 1/3, bottoming out in 2009 with 583,000 building permits issued the entire year -- or just over 1/4 of the 2004 peak.

Going back more than half century, the only years in which more than 2,000,000 building permits were issued were 2004 and 2005, and then all the way back to 1972. 1972 was the high-water mark for permits, at 2,218,900 that year. 2009 was the lowest point in that span.

During that time, annually about 1% of all homes, and 6 to 7% of all rental properties, were vacant at any one time. Those numbers stayed pretty constant during the recessions in the 70s, 80s, 90s, and 2000s. They peaked, of course, during the Great Recession in 08-09, rising to 3% and 10.5%, respectively.

3% isn't much, it seems, until you remember that there are about 124,600,000 households in the US, so in 2008-2009 there were 3,738,000 vacant houses.

What's striking about all that data is how different 2008-2009 were from prior economic downturns. Building permits stayed steady through all the prior recessions in the past 50 years; housing vacancies stayed steady, too. But in 2008-2009, building permits dropped by 75% from the high just 5 years earlier, while vacancies tripled.

Here's a question: what happened to all those vacant houses?

Here's an answer: most of them are still vacant. 1,500,486 properties were "zombie" properties in 2015: they were not being lived in but were not being actively marketed. They're just there.

Here's another question: where are all those people?

We count the homeless by counting people in January and estimating the numbers from there. In January 2015, 564,000 people were estimated to be homeless on any given night. That, at least, is the official government number put out by the Department of Housing and Urban Development. That may not count all the people; the National Coalition for the Homeless notes that many homeless families "double up" with someone else, living in their house for a while. The Coalition estimates that there are about 1,200,000 children who are homeless. (That HUD estimate was in a HUD press release touting how much HUD is doing despite decreasing funds to help the homeless.)

Obama, in 2010, started a program to help "end homelessness" by 2017 -- meaning that anyone who ends up homeless will quickly get help and shelter. So far it looks like what they've accomplished is collecting data; while the government claims homelessness dropped as much as 11% in the first five years of the program, it also admits that the methods of counting the homeless are unreliable.

No catchy summations here, or ironic closing remarks. Just some stuff to wonder about. Above all, wonder about the question, why was the Great Recession so much different than the prior ones? I'm sure it has nothing to with the fact that tax rates are at an all-time low, which because we won't ever consider raising taxes at all has led to decreased funding across the board, thereby concentrating funds in the hands of a relatively small percentage of people.

Subscribe to:

Comments (Atom)